Every investor investing in different investment instruments like stocks, mutual funds, shares, or others wants to know the rate of return he can earn on his investments every year. In such a case, CAGR proves to be the most effective method. CAGR, an acronym for Compounded Annual Growth Rate, is used to measure the average annual growth of an investment over a given period. With the innovation of technology, investors can now easily calculate the rate of returns on their investments using the cagr calculator online. Read further to know how you can calculate CAGR returns.

What Is CAGR?

CAGR, short-form for Compounded Annual Growth Rate, means the average annual growth of the invested amount in a given timeframe. It is typically a measure using which you can figure out the average annual growth of an investment over a given period. For example, with the help of the cagr formula, you can know the average rate of return on your investment over a year. For a given period, the invested capital is assumed to be compounded with a growth rate equal to that of the calculated CAGR.

Now that profits are assumed to be reinvested at the end of each year over a given period, CAGR is just a representative number; it doesn’t represent an accurate return.

How To Calculate CAGR?

The compounded annual growth rate on investment can be easily calculated using the compound growth formula and following the below-given steps:

- Take the future value of investment of a given period and divide this value by the present value of the investment.

- Then, increase the calculated result to the power of one divided by the tenure for which investment has been made minus one.

Here given is the mathematical formula for CAGR:

CAGR = [(FV / PV) ^ 1 / n] – 1

where,

FV = Future value of the amount invested.

PV = Present value of the amount invested.

n = No. of years Invested

Example

Let’s take an example of how the compound annual growth rate formula can measure the annual rate of return on investment over a given timeframe.

Consider that you had invested Rs. 25,000 in a mutual fund in 2016. The investment in the mutual fund will be worth Rs. 40,000 in the year 2023.

The mathematical formula for CAGR = [(FV / PV) ^ 1 / n] -1

Here,

PV = Rs. 25,000

FV = Rs. 40,000

n = 7 years

Putting these values in the CAGR formula:

CAGR = [(40000 / 25000) ^ 1 / 7] – 1

CAGR = 6.94% per annum

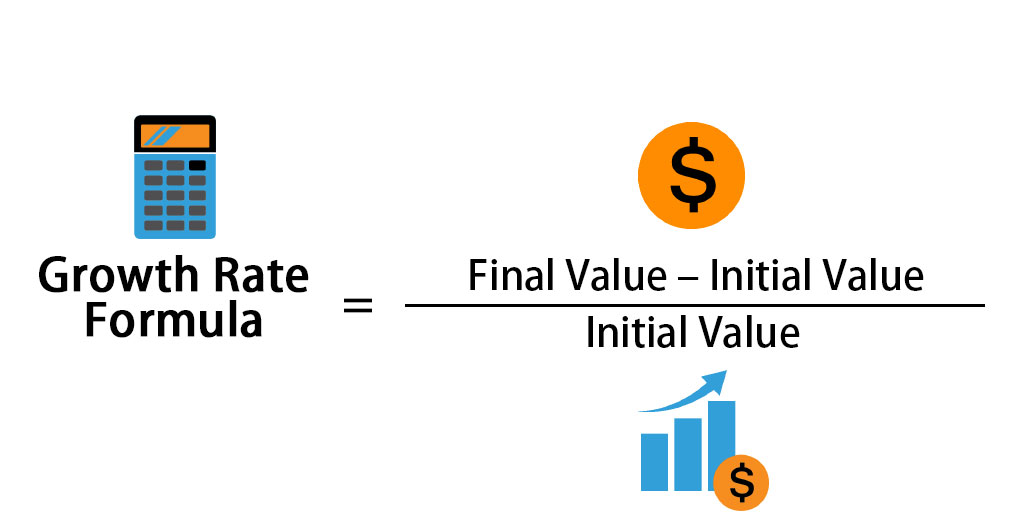

In addition to this, the absolute return on the investment can also be calculated using the CAGR calculator:

[(Future Value of the Investment – Present Value of the Investment)/ Present Value of the Investment] x 100

For the same example, the absolute return on the investment is:

= [(40000 – 25000) / 25000] x 100

= 60%

What Is A CAGR Calculator?

The cagr calculator India is a utility tool that can be accessed online for calculating the CAGR of the investment over a given period. An investor needs to enter the present value of his investment, the expected future value of his investment, and the total years for which you want to calculate the compounded annual growth rate.

How Does The CAGR Calculator Work?

The compound annual growth rate calculator has a formula box where you must select the investment’s present value and the expected final value of the invested amount. Then you have to select the number of years of the investment. After entering all the required details, the CAGR calculation tool will show your investment’s annual rate of growth within a few seconds. This rate of return can be used to compare your different investment options against a benchmark.

Benefits Of Using The CAGR Calculator:

Since you know what compounded annual growth rate is, its formula, the CAGR calculator, and how to use it, now the question is how using the CAGR calculator can be beneficial. Here enlisted are some benefits of the CAGR calculator online:

- This calculator allows investors to calculate the ARR or the annual rate of return for their investments.

- It enables investors to assess and compare investment options against the benchmark in various scenarios.

- The CAGR calculator is not only easy to access over the internet, but also it is straightforward to use. An investor only needs to enter the present value of the investment, the expected final value of the investment, and the number of years of the investment. An online cagr return calculator will take care of the rest, and you will get a rate of return on your investment within seconds.

- The CAGR calculator can calculate returns for the amount invested in mutual funds or stocks and then compare the average annual growth rate of these investments over time against the benchmark.

Frequently Asked Questions:

-

1 What CAGR percentage is considered good?

There is no set percentage for a promising CAGR for equity investment. However, in theory, it is better to have a CAGR percentage for different investments, whether equity or fixed, higher than the interest rate on a savings account.

-

2 Can I use the CAGR calculator for monthly investments?

Yes, you can use the cagr calculator for monthly investments. CMGR (Compounded Monthly Growth Rate) or CAGR can calculate the average annual growth rate for monthly investments. Furthermore, the formula for calculating CMGR is the same. You need to replace the number of years with the number of months.

Conclusion:

Calculating CAGR is significant for the investor who wants to know the average rate of return for his investment over a given period. Therefore, investors are looking for a convenient way to calculate CAGR. This is when the cagr calculator online comes for help. Anyone who wants to calculate CAGR without involving in complex mathematical calculations can use an online CAGR calculator. You can access this calculator online on official websites covering the finance sector.