Building a successful financial portfolio is a long-term journey that requires careful analysis and understanding of what assets to include. While the popular belief is that cash, bonds, and stocks make a portfolio’s core, you can include a wider range of assets. Emerging asset options include well-performing cryptocurrencies, real estate, private investments, and art.

A good practical concept in creating a successful financial portfolio is diversifying your asset options to minimize risks. If you’re starting to build a successful financial portfolio, these five tips will help you navigate the process seamlessly.

Define Your Investment Goals and Objectives

Building a successful financial portfolio starts with defining your investment objectives and goals. You’d want to evaluate your short and long-term needs and envision what you want to achieve with your investments in the future. This should include working with an insolvency practitioner like Hudson Weir to decide your total asset value and annual income and choosing suitable investments toward that goal.

One of your goals and objectives should also include cutting asset acquisition costs while optimizing returns. For instance, if you’re considering investing in cryptocurrency, you’d want to buy Bitcoin on Kraken for fair transaction charges and good withdrawal terms. The objective is to get the best assets into your investment portfolio at the most tolerable risk level.

Identify Your Investment Style and Strategy

Once you set your financial goals and objectives, it’s easier to identify the investment styles and strategies that best align with these goals and objectives. You could choose one or more of the three main styles and strategies of investments: value, growth, and income investment.

With value investment, you’ll target companies with strong fundamentals but have low stock prices that do not rightly reflect their true worth. You hope they’ll soon attain their true value and your investments will bear good returns.

For growth investments, you’re targeting companies that already show high potential for earning impressive growth in the near future. The probability of earning good returns is high, but the actual returns aren’t as high as those you’d earn in value investment.

An income investment strategy will work fine if you fancy consistent investment returns. This option promises a steady cash flow through dividends and interests for stocks and bonds. Your approach will determine how long you’ll survive in the financial market and how much you’ll earn in return.

Scrutinize Past Performance and New Trends

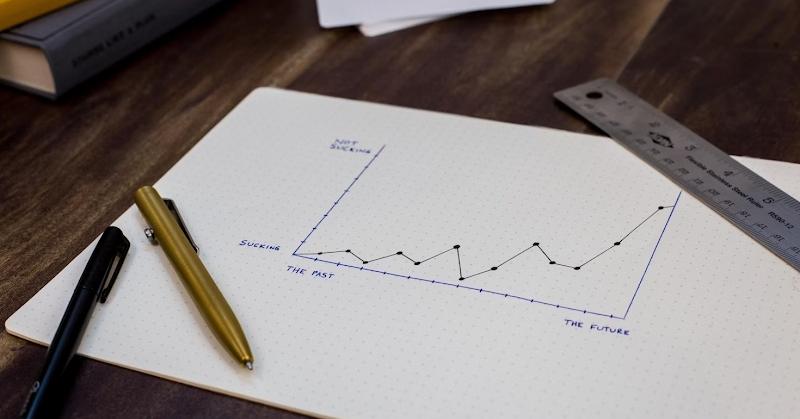

Whatever your potential investment opportunities are, it’s important to study their past performances and current trends so you can make informed investment decisions. An excellently performing asset now could be a risky option with a shaky past performance, hence the need to study its historical tracks.

If an investment opportunity has had a stable run into its current good performance, it could indicate it’ll remain there for some time or go up. You can then decide how much to invest and for how long.

Keep an Eye on Overconcentration

When building your investment portfolio, a significant percentage of your investment could lean on one company or asset class. When this happens, you may face a potentially high-risk situation where you stand to lose all your investments in that asset class in case of a hit. For instance, if a significant percentage of your portfolio goes into real estate investments, you may suffer a massive loss if the industry is economically hit.

To manage this risk, you should diversify your investment options. You could distribute your finances across various investment options like real estate, cryptocurrencies, bonds, and stocks from different international markets.

Continually Tweak Your Portfolio

If you’re eyeing long-term investment opportunities, playing by the same strategies and styles for a long time can inhibit your portfolio’s growth. You need to continually adjust your strategy and style, keeping tabs on your portfolio and checking how it performs. You could also hire a financial advisor to offer regular tips and updates on your portfolio returns.

Once you master the art of tweaking your strategies, you can stay in the pool for a long time, not having to sell your investments when things go wrong temporarily. A sound investment strategy should keep you invested for a long time so your assets can live to see the good days of significant returns.

Building a successful financial portfolio is challenging, mainly as it comes with many risks and uncertainties. However, with elaborate planning and execution of the right strategies, you can steadily grow your portfolio into a big pool of success. So, start small by defining your investment goals and grow to the point where you can continually tweak your portfolio for optimal gains.